2025 Tax Brackets Head Of Household Income

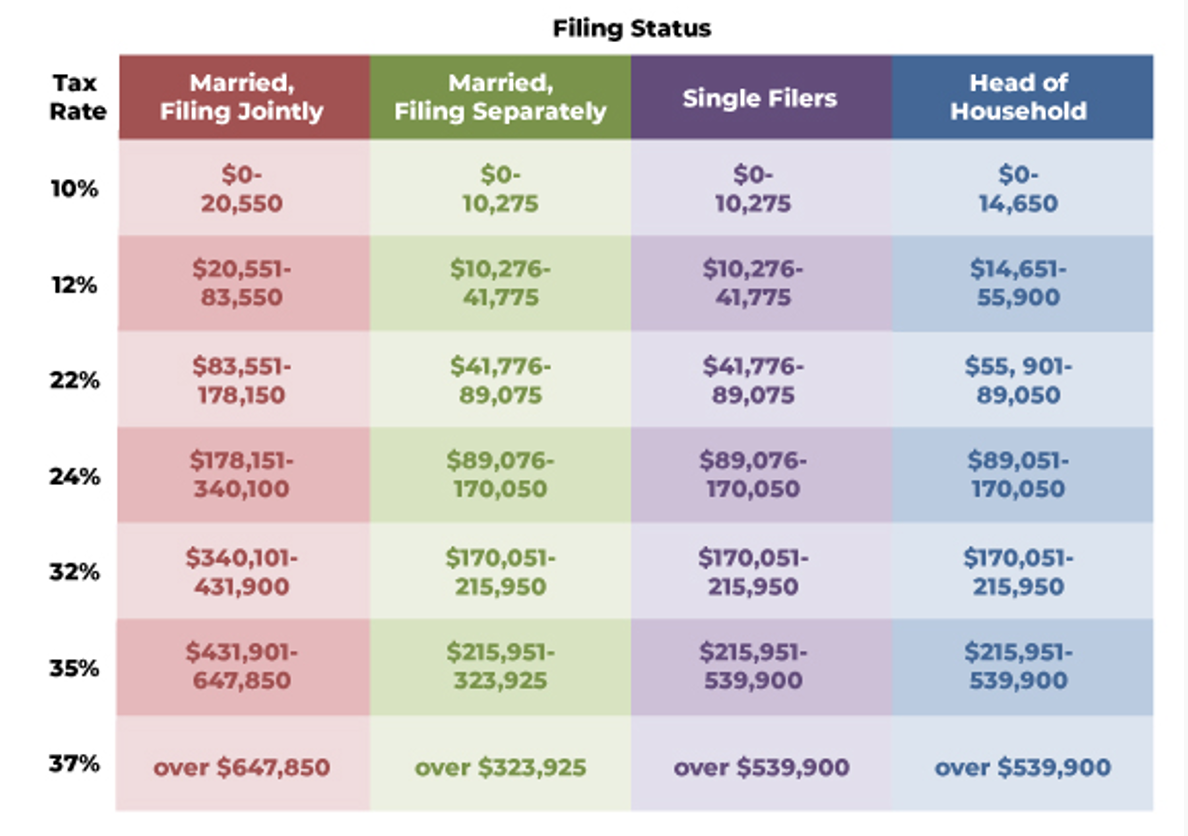

2025 Tax Brackets Head Of Household Income - 2025 Tax Brackets Frieda Shawna, See the tables for single, joint, and head of household filers. Tax Brackets For 2025 Head Of Household Leesa Nananne, — there are currently seven tax brackets that you might fall into:

2025 Tax Brackets Frieda Shawna, See the tables for single, joint, and head of household filers.

2025 Tax Brackets Single Chart Sara Wilone, — learn about the rule changes that could affect your 2025 tax filing, such as higher standard deductions, expanded income tax brackets and new reporting.

2025 Tax Brackets Head Of Household Income. — find out which federal tax bracket you fall into and which of the seven income tax rates applies to your income for 2025 and 2025. — learn how the irs adjusts the federal tax brackets and standard deduction for inflation in 2025.

Tax Brackets Definition, Types, How They Work, 2025 Rates, California resident income tax return (form 540 2ez) 7.

Tax Brackets 2025 Head Of Household Support Tarra Beatrice, — compare the irs tax brackets and rates for 2025 and 2025, and learn how inflation and standard deduction changes could affect your tax bill.

2025 Tax Brackets Head Of Household Danila Delphine, Full year residents with a filing requirement must file either:

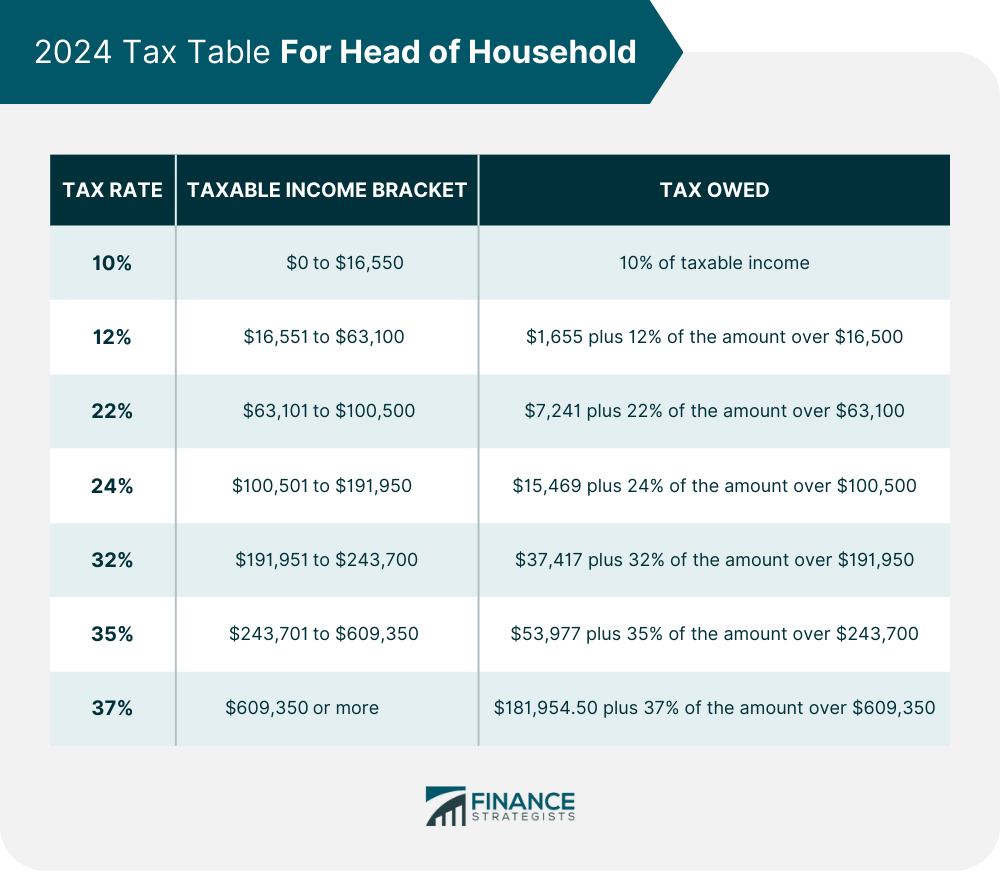

Tax Brackets 2025 Single Head Of Household Fern Gwennie, — the irs increased its tax brackets by 5.4% for each type of tax filer for 2025, including heads of households.

Tax Brackets 2025 Single Head Of Household Alys Lynnea, Estimate your 2025 taxable income and federal income tax rate with this tool.

Tax Brackets 2025 Single Head Of Household Alys Lynnea, — find out the tax rates and brackets for 2025 and 2025, including the changes due to inflation.

— the irs increased its tax brackets by 5.4% for each type of tax filer for 2025, including heads of households. Find the current tax rates and brackets for 2025 and 2025 for a single taxpayer and other filing statuses.

Tax Bracket 2025 Head Of Household Staci Corrina, Each bracket applies to a different taxable income.